Financially ILLiterate. Tariffs? Let me tare you a riff real quick

How I started my retirement journey. This is not financial advice or FDIC insured.

I maxed out my Roth 401k and my Roth IRA in the beginning of the year. Now the markets are tanking and I have a hole in my stomach. Then I filled it with the Matcha Porridge from Dimes and I’m all better now.

I decided to be financially responsible and start thinking about my future in my 30s. Obviously started late in saving for retirement. My excuse is that I never had a 9 to 5 corporate job and still don’t. Didn’t care about a 401k like my comrades living in the punk houses and the only thing we wanted to know about was how do we get healthcare and how do we collect unemployment.

I remember when I first started investing. It was during lockdown in the Covid pandemic at the age of 29-30. I opened up my Roth IRA account with TD Ameritrade now owned by Charles Schwab. Do you know what I just said? I only ask because my brother who has been in corporate since graduating college told me he has no idea what I said. Then I found out how who’s operating his retirement.

The hardest part of signing up for retirement was signing up. Growing up as a punk kid with immigrant parents is difficult. Our parents are trying to meet in the middle of taking care of their kids and having a good future. Their wellbeing is filled with so many compromises with their children, it’ll never be perfect. Generations. The best part I love about my parents is that they’re optimistic. They see the positive side of things. I walk around with a dark cloud under my head every day.

The hardest part of signing up for retirement was signing up. I have to write this twice because I didn’t want to do it at all. It took a pandemic. Lockdown. To be in our rooms with nothing else to do, to say ok, I have this money from unemployment, what should I do with it? I guess I’ll open up a retirement account. Literally did this out of boredom. Not because I care about my future. I was drinking everyday to pass the time, my wine shop knew me by name and I received a few free bottles because of the points I collected. If it wasn’t for lockdown would I still do this?

In my 20s, I did not care about retirement but I did care about saving. I grew up in a household where I was taught to save. Save up for what? No idea. A house did not cross my mind. My parents said to save up for a house one day but that wasn’t what I was thinking, I was thinking hell yeah how about a motorcycle.

I was always saving. The issue was that I’ve had a lite traumatizing experience with banks. I know I’m not the only one but here are the two that stick with me today.

When I was 16, I opened up an account with TD bank. I was saving and spending out of the account, I kept getting my account close to 0. In Atlanta, the scene where Donald Glover wants to pay for his date but has no money, that’s me. What sucks about being a teenager and trying to keep afloat is that I kept getting withdrawal fees for wherever I went and fees for now having my account at a certain amount. Of course I would, I ain’t making shit at Panera fam. Realizing I was always in hell for this and that banks are the devil. Of course they are. I got out of TD when I discovered credit unions exist from my dad. Credit unions rule because they don’t do anything. They’re clean, let you chill, don’t care about who you are except that you’re family. That’s all I want. A family of money.

The second time happened when I was in Community College and I was at the Community College job fair. There was a sweet lady who worked at a Federal Bank she campaigned for that needed a super super Jr. Designer. Very super, so I gave her my portfolio. She loved my vibe. Imagine an 18 year old, Wear Many Hats Rashad host making sure my charm is up to date with this nice lady. It was a good conversation. She gets my email, takes my calls, then sets me up with an interview. I get there, wearing a tie, my dress shirt is tucked in, my hair is swooped to the side and I sit down with the old white overweight crumbly manager who’s talking to me. He tells me he likes my work but says that I’m overqualified. I’m 18 years old. I need money. I have no money, no skills. Nothing. I felt the racism in the room because it made no sense. I wanted the job so bad. After that I swore off wanting to work for banks or listen to people in finance.

As I hopped from job to job, I was only saving to survive. Not by putting it in the market, or investing, what does any of that mean? Until during the pandemic, I started to do so. Even though we all thought it was the end. I invested ever since, bears turn to bulls and I got the hang of it.

In all seriousness, I’ve been learning about investing and retirement through podcasts, books, and my favorite, the Bogleheads subreddit.

Meet Bob, the World’s Worst Market Timer. It’s a story about Bob is the world’s worst market timer. Only invests in peaks and then crashes. Take it as you will but it’s a good story to make you chill out and don’t let your emotions get in the way. “Stay the Course” is what Bogleheads say.

All of this is what I never thought I would say or write in a million years. Even when you look at me, does it look like I know any of this or even care to know? Of course not. Our creative art friends are saying VOO this, VOO that. Do you VOO Rashad? Of course not. I wear ripped socks.

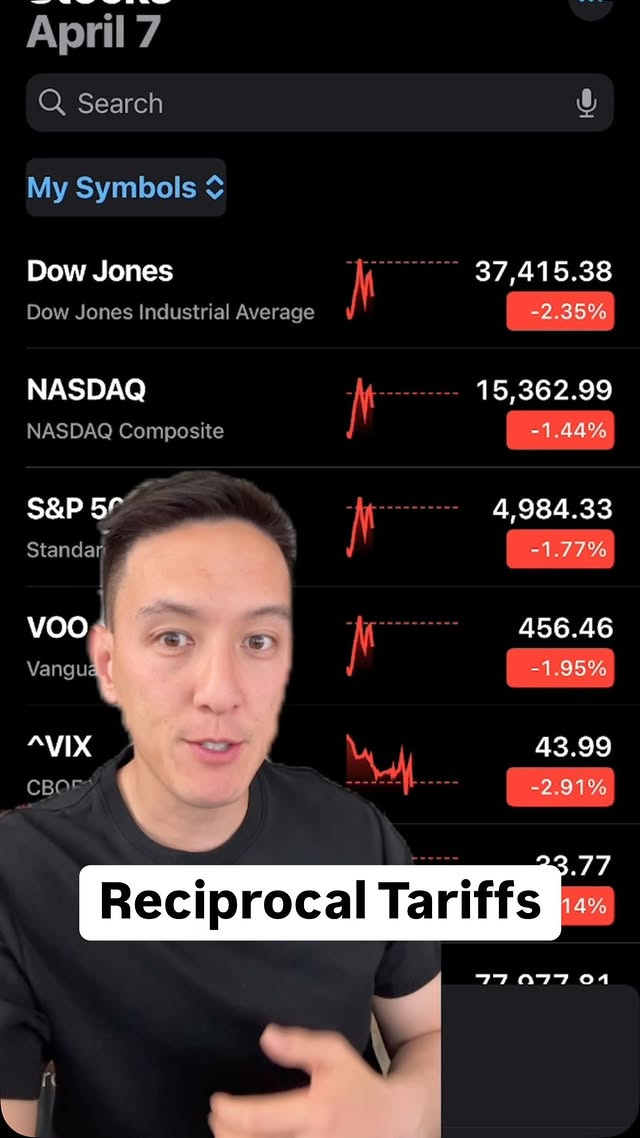

In the beginning of 2025, I remember people saying it’s the year of crashing out. The butthole who’s in office right now is moving forward with tariffs. There were signs that this was going to happen. Do I sound like Gen Z or staying a true millennial?

Now we’re in Hell. 7x and counting bankruptcy+felon leader of the free world is messing with our money again. My parents retired last year and I feel bad for them. People are stock piling toilet paper again. I’m waiting till the market stops bleeding so I can get back in again.

This morning I let my emotions get the best of me but you only lose when you pull out. First time that has ever been a negative connotation because I always tell people to pull out. I hope people get what I’m saying with this part. If not, then ask me when you see me.

How I’ve been able to keep calm and not let my emotions get the best of me is surprisingly -don’t make fun of me- is by listening to the new Skrillex album.

A couple years ago, a person of Generation Z, asked me how much money I had in my bank account. She wanted to see if she had more. Yes. To compare bank accounts. It goes against everyone was taught except the libby, stop gatekeeping crowd. Hell, I wanted to entertain the idea. I told her, if she shows me first. She showed me her bank account. It was healthy and I could see how happy she was showing me it. In public mind you. It was my turn and she wanted me to do the same…

Of course I said Hell no! I’m not doing that. Who would ever do such a thing unless you’re married or in a healthy relationship with your partner. Crazy ass. Then she wanted to take a guess. I said ok you can guess. She guesses $1,000! I love it. It was truly entertaining.

I said that I have no money and that you should get dinner tonight. She did. Felt sorry for me. How did I get myself into this situation. Your guess is as good as mine.

God I love 3sixteen and everything they stand for. This is a great video of how Tariff’s are going to f us all. Picking up 3sixteen on my day off.

If you were homeschooled, yes the tariffs are going to be messing us up big time Chad. I started a matcha wellness brand called Matsar and everyones been asking me if it’s hurting me. Yes fam. Orders I’ve placed months back are coming in and I have to pay fees when it reaches my door.

What I’ll leave you on today’s Wear Many Hats financial edition is that my dad said to to always stay positive and this too shall past. My Gandalf.

While we’re still in Mercury Retrograde, of course your mans going to ball. That’s how we do it. When we down, we better go out with a bang. Here’s what I copped lately:

Mini Tool Box in Silver by Toyo

Cantilever Toolbox ST-350 SV by Toyo

Serving Cart in Pure White by USM Haller

Stalogy Notebook by Yoseka Stationary

100% Italian Grain Bucatini by Afeltra

True Blues Heirloom Eggs by Vital Farms

Investing in yourself is the best thing I’ve ever done. As corny as that sounds. Putting money back into your projects and learning new things is the best thing you can do with your money.

After all of this mess, I’m getting a financial advisor.